When I took my daily walk last week, I noticed that my feet felt as if they were walking uphill, even though I was on a completely flat surface.

The minute I got back home, I took off my walking shoes and examined them. The back edges of the heels on both soles were so worn out, I practically was walking on my socks.

I wasn’t surprised, however. I faithfully walk more than 15 miles every week and I bought my current pair of shoes back in 2023. So I've racked up a lot of mileage on them.

That night, I searched the Internet for another pair of walking shoes exactly like mine and was shocked to discover the price had gone up $30 since the last time I'd purchased them. I was determined not to pay that much, so I continued my search. An hour later, I finally found a pair on sale for only $10 more than I’d previously paid. And luck was on my side because the sale was ending in an hour. I’d found the shoes just in nick of time.

I filled out the order, then entered my debit-card number and the expiration date.

TRANSACTION DENIED flashed on the screen.

I tried again. Ditto.

So I checked my online account. Nothing looked suspicious and I had more than enough money in it to buy the shoes.

Two more failed attempts later, I finally raised the white flag. I knew I had no choice other than to do something more stressful and more painful than wearing barbed-wire underwear.

I phoned my bank’s 24-hour customer-service line.

To my relief, it didn’t take too long to be connected with an actual human. I had to sit through only 12 choruses of some song that sounded as if it were being played on a toy piano, and a mere eight advertisements for a credit card that would give me 2-percent cash back on every purchase. But if I didn’t pay off the balance every month, I’d get hit with an interest payment of 26-percent.

Call me a skeptic, but those odds didn’t exactly entice me to rush to fill out an application.

The customer-service woman asked me several questions to verify my identity. She then said that before she could access my account and provide me with any information, she was going to phone a code number to me that I had to repeat to her.

I tried to tell her I still was using a landline that didn’t even have call-waiting, but she too quickly sent the code number, which went straight to my voice mail. So I wasn’t able to access it unless I hung up, dialed the voice-mail phone number and then entered my home-phone number and PIN, which, on a good day, would have taken about a year and a half.

When I explained all of this to the woman, she responded with, “You really don’t have a Smartphone?” Her suspicious tone told me I probably had just become a suspect instead of a victim.

“The reception is terrible where I live,” I said. “That’s why I still have a landline.”

“Then I can’t send you a text, either?” She asked in a way that made me feel as if she thought I should be hanging around with Wilma Flintstone.

“Not unless you know how to send a text through an old-fashioned landline.”

She then said she was going to have to ask me more security questions. I expected the usual, "What's your favorite movie?" or "Who was your first-grade teacher?" but instead, the questions were all about my other accounts and transactions at the bank, dating all the way back to when the Pilgrims first landed at Plymouth Rock. Finally, she trusted me enough to share some information with me.

“It seems your account was frozen because someone named McAfee attempted to make an unauthorized purchase,” she said.

“That would be McAfee Security,” I said, “my computer’s virus protection. Every year at this time they automatically take out my annual fee. It’s a legitimate purchase.”

“And exactly how much is that fee?” Her suspicious tone returned.

Maybe it was just my imagination, but I thought she sounded a bit disappointed when I answered with the correct amount. Maybe she'd been thinking she was about to bust an international ring of debit-card hackers led by me, “Big Mama Breslin.”

“So now you can remove the hold on my debit card?” I asked her.

“Sorry, but no. You weren’t able to repeat the code number back to me and I’m not allowed to issue you another one today, so now I'm not authorized to change anything in your account.”

I looked at the clock. The shoe sale was over. Someone else was going to be jogging in my new shoes, while I probably was going to end up walking in my bedroom slippers.

“Then what do you suggest I do next?” I asked.

“Well, you can call back tomorrow morning and we can try again because it will be a different day. Or you can visit your nearest branch in person. Or…” she lowered her voice, “there’s one other thing you can try that I think might work more quickly.”

Her tone sounded so mysterious, I was afraid to ask. Visions of myself sharing a prison cell with a giant of a woman with biceps the size of tree trunks and “KILLER” tattooed across her forehead immediately sprang to mind.

But the customer-service woman simply told me to log into my online account, click onto “send a secure message” and write that I’d authorized McAfee’s payment and the amount, and then request to have my debit card unlocked. She also gave me a case number to add to the message, which she said might help to speed up the process.

So I tried it, figuring I had nothing to lose at that point. Five hours later, I received a response from the bank, apologizing for the inconvenience and informing me my card was all set to use again.

I was relieved, but also discouraged. I mean, although I was really grateful to the bank for being so cautious about my debit card, the fact remained that I’d missed out on the shoe sale and now would have to pay at least $89 for another pair.

The next day, I once again browsed online for shoes and was surprised to see a pair just like mine on sale elsewhere for even less than the ones I’d unsuccessfully tried to order. I immediately ordered them, then held my breath as I entered my debit-card number.

It was accepted! (Exhale!)

I honestly haven’t felt that relieved since the time I rushed to see my doctor because I was experiencing tightness and discomfort in my chest and was convinced I needed open-heart surgery.

After I underwent a variety of tests, the doctor said, “Well, my diagnosis is…you need to buy a bigger bra.”

Yep. Definitely a big relief...in more ways than one.

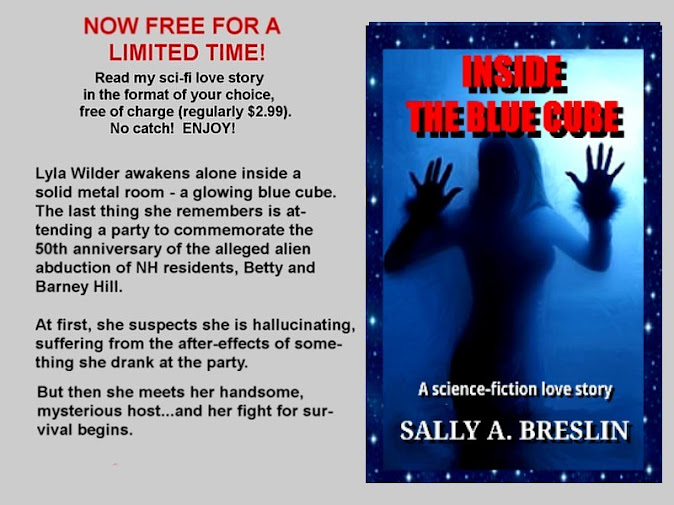

Sally Breslin is an award-winning syndicated humor columnist who has written regularly for newspapers and magazines all of her adult life. She is the author of several novels in a variety of genres, from humor and romance to science-fiction. Contact her at: sillysally@att.net.

No comments:

Post a Comment